Which transition option is right for you?

Generally, successful business transition outcomes happen when the owner clearly defines goals and objectives, often years before the transition occurs. There are several common transition options, and owners should understand how these alternatives align with their goals. A disciplined process helps owners plan and execute a successful transition, thereby potentially maximizing outcomes for all stakeholders.

Think ahead about the right solution for you

At some point, nearly every business owner faces a business transition. Since the enterprise often represents the single largest asset on the personal balance sheets of many owners, its value can represent a lifetime of focus, energy, and work. Given this personal investment, the decision to transition a company can be difficult. Clearly articulated goals, both quantitative and qualitative, and a solid understanding of the transition options can help enable a successful outcome not just for the owner but for all key stakeholders.

Identify your goals and objectives

As the largest asset for many business owners, the company is typically the primary source of funding for meeting retirement, philanthropic, and legacy goals. Understanding the financial requirements of each of these objectives is a key first step in any business transition planning process. Your financial advisor can play an important role by helping to model and give shape to these quantitative goals.

Your qualitative goals are often as - if not more - important than your financial goals. Among the many considerations in planning a transition, some of the most important are:

- Timing

- What happens to key stakeholders: the management team, rank and file employees, major customers and suppliers

- Business / family legacy

- Owner identity and purpose post-transition

Analyze the business

As with identifying goals and objectives, analyzing the enterprise considers both qualitative and quantitative factors. Industry dynamics, company performance, and market conditions, among other things, can impact a company’s worth and the available transition alternatives. Obtain a preliminary valuation or range of value for the business to confirm that it may meet your objectives. If the preliminary valuation falls short of those goals, look for ways to increase company value.

The strength of a company’s management team can be a critically important factor in certain transitions. Management buyouts, sales to employee stock ownership plans (ESOPs), and sales to private equity can be difficult transition paths without a strong management team in place. Special arrangements to develop and retain these key employees, such as employment, non-compete, non-solicitation, and incentive arrangements, should be considered.

Consider transition options

Most owners face a predictable set of alternatives for the transition of their business. The suitability of these options can differ in material ways depending on an owner’s objectives, the company’s position within the industry, and market conditions. The business transition planning process typically includes a simultaneous review of multiple options and may include:

- Keep / family transition

- Sale to strategic buyer

- Private equity recapitalization

- Internal or management buyout (MBO)

- Employee stock ownership plan (ESOP)

Each option has distinct advantages and potential issues to consider. The most appropriate type of business transition will depend on an owner’s near- and long-term transition planning objectives, the company’s current performance, and prevailing market conditions, as well as other factors.

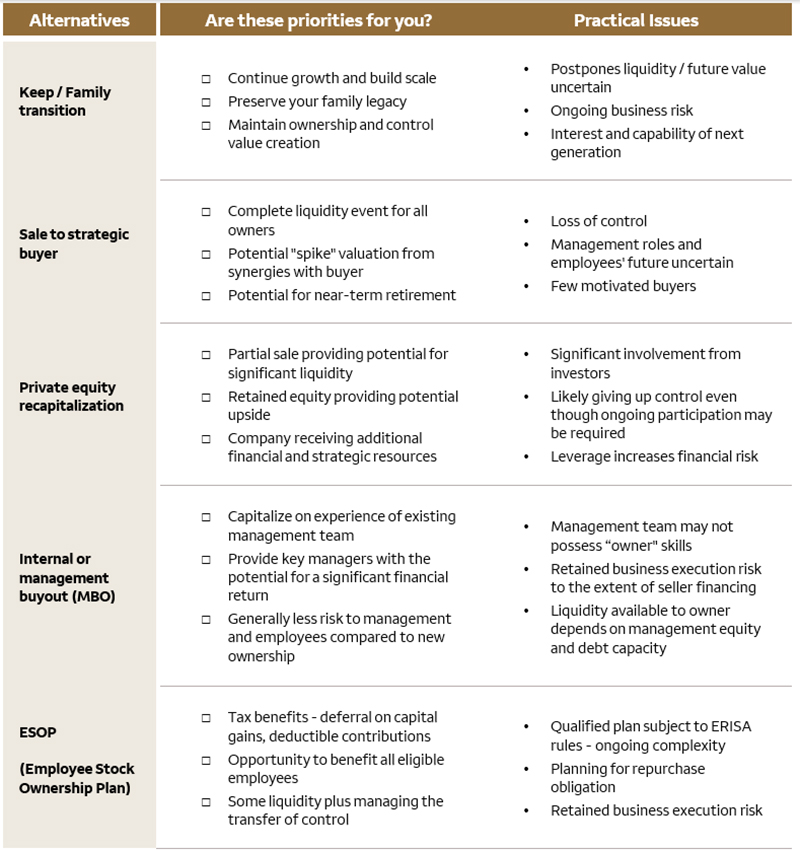

The table below summarizes common transition alternatives and important considerations.

| Alternatives | Are these priorities to you? | Practical Issues |

|---|---|---|

| Keep / Family transition |

|

|

| Sale to strategic buyer |

|

|

| Private equity recapitalization |

|

|

| Internal or management buyout (MBO) |

|

|

| ESOP (Employee Stock Ownership Plan) |

|

|

Here are some drivers that could influence your decision to pursue one option or another:

- What are your objectives?

- What are the industry dynamics and how is the company positioned?

- What are the mergers and acquisitions (M&A) and capital market conditions?

Actionable next steps

- Work with your advisor to understand the financial requirements of your personal goals: what amount of financial return do you need from the transition of your business to fulfill those goals, and when?

- Talk with an appraiser or other specialist for guidance around the company’s valuation, potential trajectory, and relevant market information.

- Think about your priorities, particularly around your preferred timeline, key managers, or other family members: how do these priorities mesh with the common transition options?

While business transitions can be complex, following a disciplined process can help owners confidently plan and execute a successful transition and potentially maximize outcomes for all stakeholders. To learn more about business transition planning, consult with your advisor.

Wells Fargo & Company and its affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.

Wealth & Investment Management offers financial products and services through affiliates of Wells Fargo & Company. Bank products and services are available through Wells Fargo Bank, N.A. Investment products and services are offered through Wells Fargo Advisors, a trade name used by Wells Fargo Clearing Services, LLC, and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Wells Fargo Bank, N.A. (“the Bank”) offers various banking, advisory, fiduciary and custody products and services, including discretionary portfolio management. Wells Fargo affiliates, including Financial Advisors of Wells Fargo Advisors, may be paid an ongoing or one-time referral fee in relation to clients referred to the Bank. In these instances, the Bank is responsible for the day-to-day management of any referred accounts.