Getting remarried is a great opportunity for both of you to do a little financial house cleaning. Start by assembling your financial team: attorney, accountant, and financial advisor. You likely each have your own professionals. You can discuss how they can work together—or if you will consolidate services.

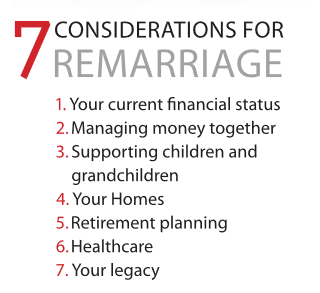

Here are some issues to start your discussions:

1. Your current financial status

You and your partner may come to the marriage with similar or very different financial resources. Either way, it’s time to take a candid look at your income, assets, and debts. Be sure to review all your income sources to find out whether remarriage would affect a particular income source.

Other items to check include bank accounts and investments. This is also a good time to discuss credit scores, jobs, and whether you have debts from an earlier marriage.

2. Managing money together

If you haven’t tied the knot yet, consider a prenuptial agreement. Not all couples need a prenup, but depending on your situation, you may want to discuss it with your attorney.

This is also a good time to discuss how you’ll manage money. Decide whether one person will be the primary bill-payer or whether you’ll split the duties. Discuss whether you’ll keep separate accounts, set up a joint account, or have both. Talk to your accountant about how remarriage may affect taxes for both of you.

3. Supporting children and grandchildren

One of the biggest challenges with remarriage can be finding the right balance with your new blended family. If you’re supporting children or grandchildren, it’s important to agree on how support will continue when you’re married.

Consider having open discussions with family members about your plans. Helping them understand your decisions may help avoid resentments and make everyone feel part of your new life.

4. Your homes

If both of you own a primary residence, discuss where you’ll live once you’re married and what you’ll do with the other home—or both of them. Your accountant may help you weigh the pros and cons of continuing to own other properties, such as a condo at the beach or rental property.

5. Retirement planning

If you’re still working, discuss when you’ll retire and how you’ll fund the retirement years. If there is an age gap between spouses, one of you could still be working when the other retires. Consider how that would affect your finances and your life together.

Review the beneficiaries on life insurance policies, 401(k) accounts, annuities, pay-on-death (POD) and transfer-on-death (TOD) accounts, and Individual Retirement Accounts (IRAs) to ensure they’re up-to-date. Be aware that a beneficiary designation on individual accounts supersedes designations in a will or trust.

6. Health care

It’s vital to review your future health care needs. If one or both of you still works, evaluate your disability benefits. As a new couple aging together, you should also consider planning for long-term care. If your partner always planned to live at home and you picture yourself in a retirement community as you age, now’s the time to talk about it.

Spouses should understand each other’s pre-existing medical conditions and be aware of health care directives or health care powers of attorney. Have a candid talk about what happens if one of you becomes seriously ill or is gravely injured.

7. Your legacy

Newlyweds, regardless of age, should review and update five key estate planning documents:

- Wills

- Durable powers of attorney

- Healthcare powers of attorney

- Living wills

- Revocable living trusts

The choices you make with your new partner may affect what you leave to your beneficiaries. Talk to your financial advisor, attorney, and accountant about your new estate planning goals.

A new chapter

As you have these discussions, try to avoid bringing preconceived notions about spending habits, debt, supporting children, or other issues into your new union. Talk things out and start with an open mind.

Next steps

- Have an honest conversation with your spouse, fiancé, or fiancée about all your income, expenses, assets, and debts.

- Schedule appointments to meet with your financial advisor and your attorney to discuss what items, such as wills, insurance policies, and investment plans might need to change.

Wells Fargo Advisors is not a legal or tax advisor.