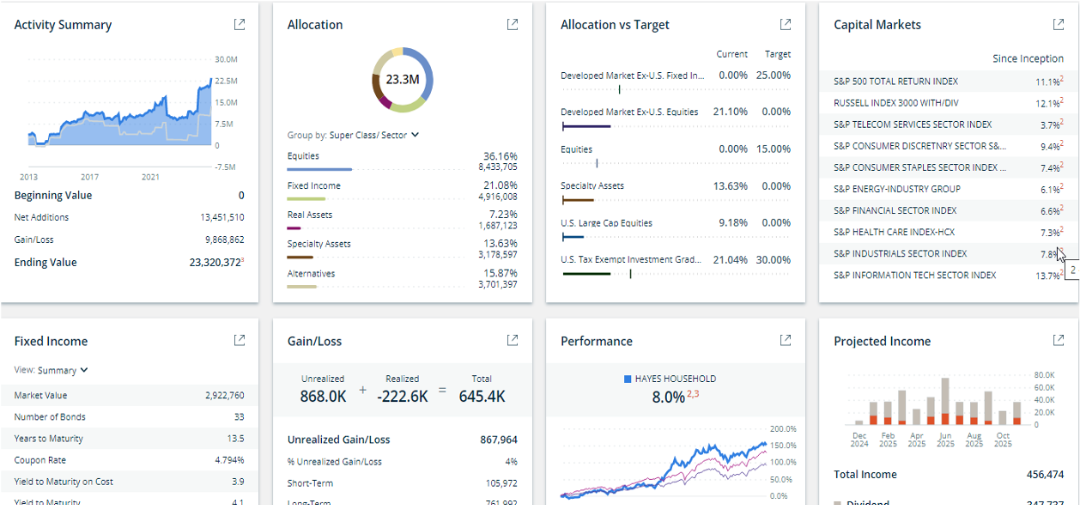

Account 360 provides advisors with a centralized, customizable platform to view and manage household and account level data, streamlining access to positions, balances, activity, and performance insights. With intuitive workflows integrated into Advisor Gateway, realtime updates, and integrated tools like FactSet and eMoney, advisors can efficiently monitor portfolios, track client goals, and prepare for meetings. This unified experience can help enhance productivity and enable more informed, personalized client interactions.

COMS streamlines the onboarding process and simplifies the client experience through digitization for a wide range of advisory programs—including Asset Advisor, Custom Choice, and Personalized Unified Managed Accounts (UMA)—by automating data retrieval and reducing manual entry. Advisors benefit from features like pre-populated household values, integrated fee calculations, and intuitive discretion settings, all designed to simplify account setup and minimize errors. COMS continues to expand to include additional product types across our platform, evolving to support a more efficient and advisor-friendly workflow.

CRC is the firm’s one-stop shop reporting tool that combines content from multiple resources to provide a consistent and flexible Client Reporting experience, ensuring clients stay informed and on track. CRC enables efficient report generation through production of pre-approved pages with a consistent set of disclosures, and provides modern, customizable report templates, from full client reviews to single reports from various sources including: Net Worth, Performance Reporting, Asset Allocation, Tax Reporting, Portfolio Analytics (equity & fixed income content), Wells Fargo Investment Institute (WFII) reports, and more.

Document Center offers a simple, digital solution for securely sharing and retrieving documents between advisors and clients. With automated status updates, centralized access, and controlled visibility, it streamlines communication and reduces administrative friction. This tool enhances relationship management by keeping important documentation organized and easily accessible, supporting a more efficient and professional client experience.

Dow Jones News delivers comprehensive coverage of North American industries and companies, helping advisors quickly access relevant financial news. With integrated access to The Wall Street Journal and Barron’s, advisors can stay informed on market trends, supporting more timely insights and informed client conversations.

Money Movement offers advisors a flexible, streamlined way to manage client cash transfers—including Automatic Clearing House (ACH), journal, and wire transfers—with enhanced control over setup, editing, and tax withholding. Whether initiating one-time or recurring instructions, advisors can now pause, resume, or update transactions with greater ease, transparency, and straight through processing. This upgraded experience simplifies operational tasks and supports more responsive, personalized service for clients.

Morningstar Tools allows advisors to instantly generate key reports like Portfolio Snapshot, Portfolio X-Ray, and Stock Intersection, helping visualize client portfolios with clarity. The tool is integrated into the Morningstar Workstation suite, which further enables a seamless generation of client holdings activity for deeper analysis and planning needs. With flexible options to select accounts, benchmarks, and investment universes, it supports more personalized and datadriven client conversations.

ResearchCenter is a platform that consolidates proprietary research from Wells Fargo Investment Institute and top-tier correspondent providers, offering powerful tools for screening and detailed analysis. Recent enhancements allow advisors to share research reports via secure hyperlinks—eliminating bulky attachments and streamlining client communication with built-in disclosures and expiration tracking. With intuitive navigation and video guides, ResearchCenter supports more efficient access to insights that elevate client conversations and investment decisions.