Roth individual retirement accounts (IRAs) are often seen as a preferred investment account because of the focus on the “income-tax free” distributions that are available. However, this is where a Roth IRA can become complicated. That’s because the Internal Revenue Code (IRC) rules around distributions from a Roth IRA are fraught with specifics, depending on the status of each account and each owner. It pays to know the rules.

Qualified and nonqualified distributions

Roth IRAs have two types of distributions, qualified and nonqualified. Knowing the difference will help you understand if you will owe income tax on the distribution. You may owe a 10% additional tax on early distributions, meaning those taken before you are age 59½, that are included in gross income.

Qualified distributions, which are tax-free and not included in gross income, occur when your account has been funded for more than five years and you are at least age 59½, or as a result of your disability, or using the first-time homebuyer exception or taken by your beneficiaries due to your death.

The five-year waiting period for qualified Roth IRA distributions begins for all of your Roth IRAs on January 1 of the first taxable year for which the account was funded and ends on December 31 of the fifth year. If, for example, you open a Roth IRA for the first time in 2024 and make a 2023 Roth contribution by the 2023 tax filing deadline, that contribution is retroactive to January 1, 2023, which is also when your five-year waiting period begins.

A nonqualified distribution is one that does not meet the above requirements. Does that mean nonqualified distributions are included in gross income? Not necessarily.

Roth IRA distribution rules

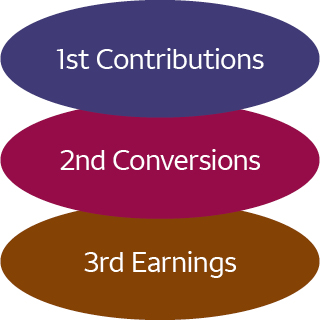

Unlike Traditional IRAs, there are ordering rules when taking nonqualified distributions from a Roth IRA.

- Contributions come first — The first amounts distributed from any of your Roth IRAs, if you have several accounts, are annual contributions. Because Roth IRA contributions are not deductible, they are not subject to tax or included in gross income and can be taken at any time.

- Converted dollars are next — After you have exhausted all of your contributions, the next amounts distributed are from any conversions you have completed. These conversion amounts are distributed tax-free on a first in, first out basis. Converted amounts taken before the five-year holding period, or you are at least age 59½, whichever is first, may have a 10% additional tax, unless an exception applies.

- Earnings are last — The last money is distributed from earnings. Earnings taken before the account has been funded for longer than five years and you are at least age 59½, or you are disabled, or using the first-time homebuyer exception ($10,000 lifetime maximum), or taken by your beneficiaries due to your death, are subject to income tax and the 10% additional tax, unless another exception applies.

- Exceptions to the 10% additional tax — The exceptions include distributions after reaching age 59½, death, disability, eligible medical expenses, certain unemployed individual’s health insurance premiums, qualified first-time homebuyer ($10,000 lifetime maximum), qualified higher education expenses, Substantially Equal Periodic Payments (SEPP), Roth conversion, qualified reservists distribution, qualified birth or adoption expenses, or IRS levy. See a full list at IRS.gov. Wells Fargo Advisors has provided this link for your convenience but does not control or endorse the website and is not responsible for the products, services, content, links, privacy policy, or security policy of this website.

Keep in mind

- You do not have to take required minimum distributions (RMDs) from a Roth IRA during your lifetime, optimizing the opportunity to build tax-free wealth.

- If your spouse is the Roth IRA beneficiary, they will not have RMDs if they roll over or transfer the Roth IRA and treat it as their own. This allows for an additional period of tax-free compounding of potential earnings that can help grow your family’s wealth.

- Beneficiaries can distribute earnings tax-free from an Inherited Roth IRA as long as the Roth had been funded for more than five years.

Distributions from Roth IRAs — ordering rules

Contributions — Distributions are not subject to tax because they are not included in gross income and can be taken at any time.

Conversions — No taxes are owed (already paid at conversion). No 10% additional tax owed if:

- More than five years have lapsed; or

- Age 59½ has been obtained; or

- One of the exceptions to the 10% additional tax has been met

Please note: each Roth conversion has its own five-year holding period

Earnings — No taxes or 10% additional tax are owed after the Roth IRA has been funded for more than five years and you are at least age 59½, you are disabled, or using the qualified first-time homebuyer exception ($10,000 lifetime maximum), or taken by your beneficiaries due to your death. Exceptions to the 10% additional tax apply.

Please Note: This material has been prepared for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. The accuracy and completeness of this information is not guaranteed and is subject to change. It is based on current tax information and legislation as of June 2025. Since each investor’s situation is unique, you need to review your specific investment objectives, risk tolerance, and liquidity needs with your financial professional(s) before a suitable investment strategy can be selected. Wells Fargo & Company and its affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.