Successful advisors know that changing firms isn’t just about finding what your practice needs right now. It’s about identifying a partner that can help fuel your future and provide you with the choice you need to grow your practice your way.

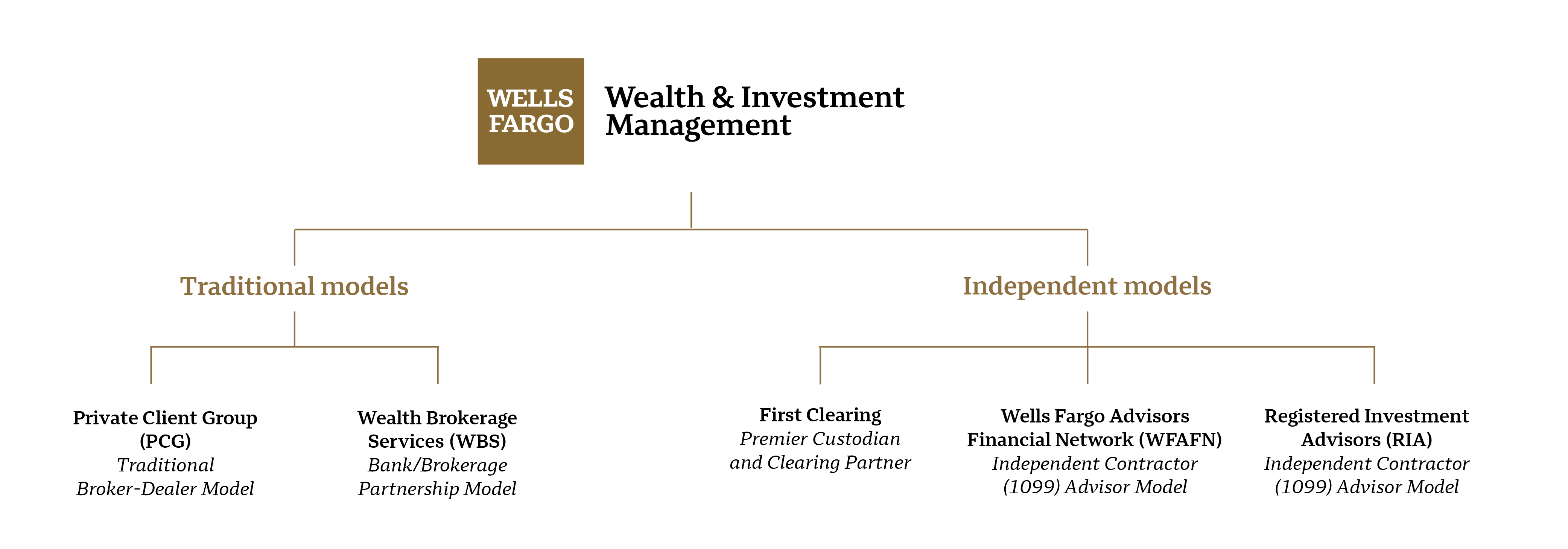

At Wells Fargo Advisors, we offer multiple ways to structure your practice including both employee models and independent solutions. As your practice grows and your goals evolve, you can pivot to the business model that best suits your vision.

Independent Model

Wells Fargo Advisors Financial Network (FiNet) offers advisors true independence backed by the power of a global institution. So you can enjoy all the benefits of independence – owning your brand, controlling your practice, and building your own culture – while retaining access to the full suite of resources to fully support your clients.

Employee Model

Private Client Group (PCG): In this traditional broker-dealer model, you join the majority of Wells Fargo Advisors Financial Advisors with access to our full range of product and service solutions. Client relationships are primarily originated by you as you work with them on planning, advice, and best practices adoption.

Wealth Brokerage Service (WBS): This channel offers the experience as a financial advisor working in Wells Fargo Bank branches with client relationships originating both from you and from banking team referrals. You maintain the same access to the firm’s resources to meet your clients’ needs.

Wells Fargo Advisors Private Wealth Financial Advisors: Unique to our firm, a financial advisor who wishes to focus on working with high-net-worth clients ($5M + AUM). You’ll collaborate with partners in Wells Fargo Bank, Enterprise Segments, and Wells Fargo Securities Investment Banking coverage teams to address clients’ wealth management needs. Our Private Wealth Financial Advisors are located both in Private Wealth hubs and throughout the branch footprint.

Teaming and Succession

In addition to offering business model choices that fit every stage of your practice lifecycle, you can also choose to enhance your practice through teaming. Teaming with other successful advisors creates the opportunity to grow your practice, and better support your clients by providing them with access to advisors with different backgrounds and experiences.

Succession offers another opportunity for advisors charting the course of their practice. As you look to wind down your career, we can help you find the best succession option for your practice, helping you obtain the proper valuation and providing your clients with a smooth and secure transition.

Or for advisors looking to scale up their growth we can support your external book acquisition efforts with advisors looking for succession partners.

Joining Wells Fargo Advisors means you can tap into more choice of how you grow your practice now and in the future. If you’re interested in learning more about opportunities for advisors like you, use the button below to contact us.

Wells Fargo Bank, N.A. (“the Bank”) offers various banking, advisory, fiduciary and custody products and services, including discretionary portfolio management. Wells Fargo affiliates, including Financial Advisors of Wells Fargo Advisors, may be paid an ongoing or one-time referral fee in relation to clients referred to the Bank. In these instances, the Bank is responsible for the day-to-day management of any referred accounts.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, member NYSE, FINRA and SIPC and Wells Fargo Bank, National Association.