$01 per online trade

Clearly listed pricing and fees

Our tools, your decisions

, and

Diversify your portfolio

Choose from a wide range of

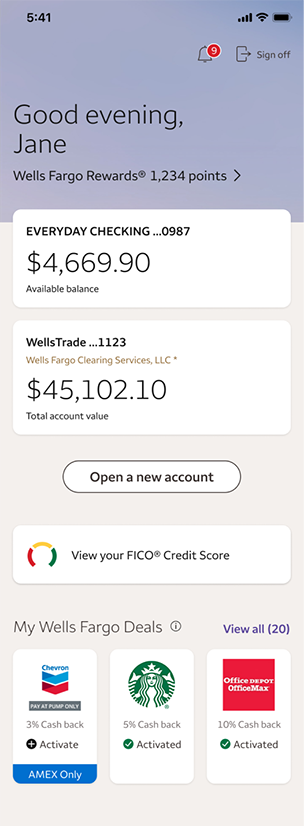

Invest and bank all in one place

between your Wells Fargo accounts

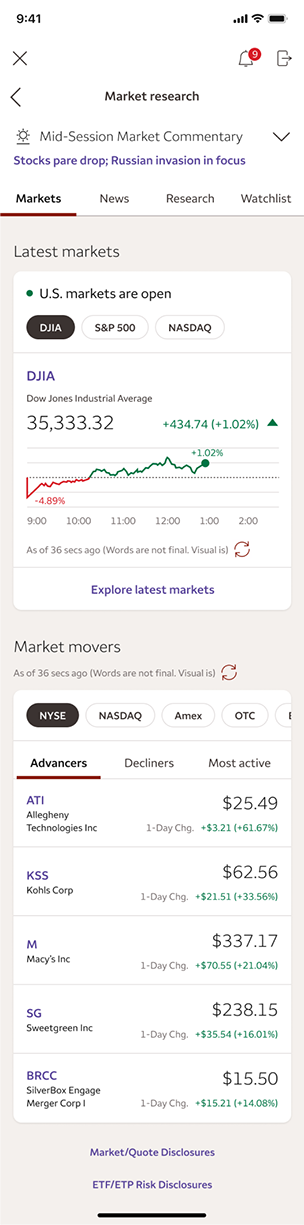

Ratings, research & real-time market news

Need help? Visit our FAQs.

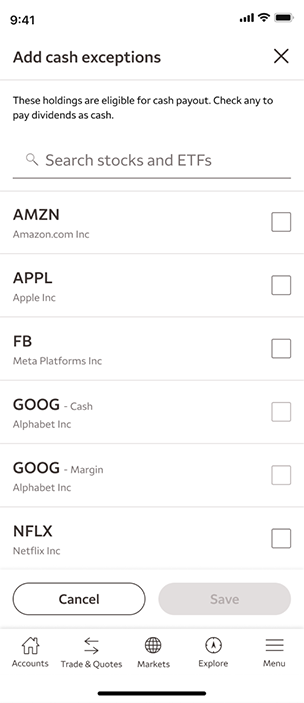

Use of stock symbols is for illustrative purposes only and not a recommendation.

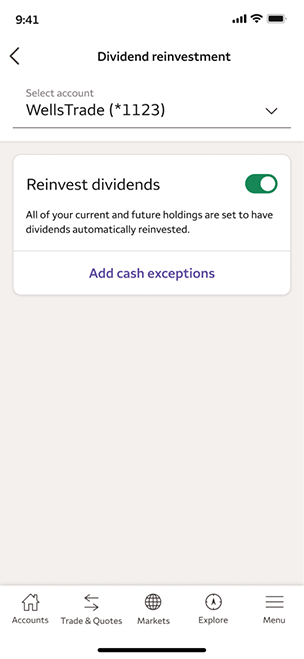

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

All investing involves some degree of risk, whether it is associated with market volatility, purchasing power or a specific security. There is no assurance any investment strategy will be successful or that a fund will meet its investment objectives. An investment will fluctuate and, when sold, may be worth more or less than the original cost.

Access to the service may be limited, delayed, or unavailable during periods of peak demand, market volatility, system upgrades or maintenance, or electronic, communication, or systems problems, or for other reasons. During times of high volume of trading at the market opening, or intra-day, clients may experience delays in system access or execution at prices significantly away from the market price quoted or displayed at the time the order was entered.

Wells Fargo Investment Institute is a registered investment advisor and wholly-owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

1$0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade order will be treated as a separate transaction subject to commission. An order that executes over multiple trading days may be subject to additional commission. One commission will be assessed for multiple trades, entered separately, that execute on the same day, on the same side of the market. Other fees and commissions apply to a WellsTrade account. Schedule subject to change at any time.

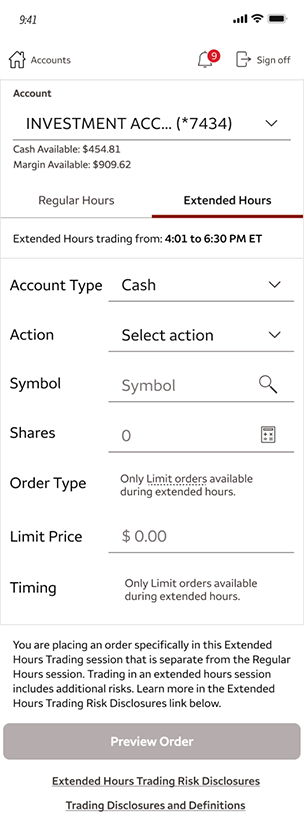

2Online Extended Hours Trading Risk Disclosures3Terms and conditions apply. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

4Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other terms and conditions apply.

5Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Account fees (e.g., monthly service, overdraft) may apply to Wells Fargo account(s) with which you use Zelle®.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

6Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

What is an asset allocation tool?

An asset allocation tool can help you keep a balanced portfolio.

Compare your portfolio against 9 asset allocation models with our asset allocation tool.

What is a screener tool?

Screeners narrow your search for stocks, mutual funds, ETFs and bonds. Choose investments based on your personal needs and goals.

What is LifeSync®?

Keep your goals in sight by keeping them on track. LifeSync helps connect you to the resources, tools, and people you need to make better financial decisions.

Investment choices

We offer a wide range of investments.

Investment products:

- Mutual funds

- U.S. stocks and options

- Exchange-traded funds

- Bonds: U.S. government, corporate or municipal

Online trades:

- Stocks

- No-load mutual funds

- Exchange-trade funds

- Options

- Money market mutual funds.

Phone trades via fixed income specialist:

- Bonds

- Treasuries

- Brokerage CDs

Easy transfers with Brokerage Cash Services

Brokerage Cash Services (BCS) comes with every WellsTrade account so you have access to a lot of ways to move your cash. Easily move money between accounts3, mobile check deposits4, quickly send money to friends and family using Zelle®5!

What is Wells Fargo Investment Institute?

The Wells Fargo Investment Institute (WFII) is our expert team of investment strategists and analysts.

Wells Fargo Investment Institute is for education, guidance, and insights to inform investment decisions. Available to Wells Fargo consumers.

What’s market commentary and real-time market news?

We use third party sources to provide access to a large collection of market news and research such as Morningstar, Moody’s and Standard & Poors.

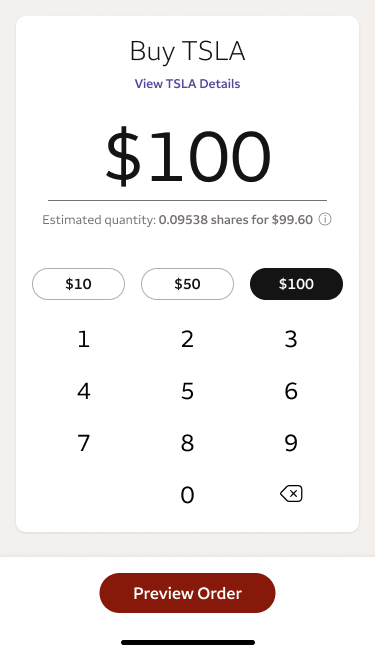

Stock Fractions℠

Stock Fractions℠ lets you buy in dollars instead of shares. No more calculating how many shares you can get for your money. Simply choose from hundreds of the most commonly traded stocks and Exchange Traded Funds at Wells Fargo Advisors, enter an amount you want to spend (from $10 to $25,000 per trade) and you’ll receive as many shares or partial shares as possible.