With Intuitive Investor® you get:

- A low cost, professionally designed portfolio

- technology

- Access to Financial Advisors

- Goal tracking with LifeSync® to set and track progress toward your financial objectives

How it works

The power of long term investing

Potential portfolio value in 20 years:

Expert designed portfolios

We've designed diversified portfolios with different risk/return profiles ranging from conservative to aggressive to fit a variety of needs.

More on portfolios*Keep in mind that diversification cannot eliminate the risk of fluctuating prices and uncertain returns.

Low cost pricing

Annual advisory fee

Low cost pricing

There is a low annual of 0.35% (discounts available1,2), plus the fees and expenses associated with the funds in your portfolio. 3

View fees (PDF)Personalized service, professional advice

Have questions? Need help?

Our Financial Advisors are here to provide guidance and answer your investment questions4.

No additional cost.

Obtain more information about our firm and financial professionals. FINRA's BrokerCheck >

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

Wells Fargo Clearing Services, LLC is not an FDIC-insured depository institution; FDIC deposit insurance only protects against the failure of an insured depository institution. Banking products and services provided by Wells Fargo Bank, N.A. Member FDIC.

1. There are also management fees and other expenses associated with the funds in your portfolio (as explained in each fund’s prospectus in the fees and expense section).

2. When you link your Intuitive Investor account offered through Wells Fargo Advisors to your Wells Fargo Bank Prime Checking, Premier Checking or Private Bank Interest Checking account, you will receive a discount on your Intuitive Investor account advisory fee. The advisory fee discount will be based on the type of checking account you have and will be applied at account opening if the account is eligible to be linked to an existing Wells Fargo Bank Prime Checking, Premier Checking or Private Bank Interest Checking account. If your Intuitive Investor account is not linked to a Wells Fargo Bank Prime Checking, Premier Checking or Private Bank Interest Checking account within 90 days, the discounted advisory fee will no longer apply and the standard advisory fee of 0.35% will apply. If the Wells Fargo Bank Prime Checking, Premier Checking or Private Bank Interest Checking account is closed, the discounted advisory fee will discontinue and revert to the standard advisory fee of 0.35%. Custodial accounts and certain trust accounts are not eligible for the Wells Fargo Bank Prime Checking, Premier Checking or Private Bank Interest Checking account advisory fee discount. Deposit products offered by Wells Fargo Bank, N.A. Member FDIC. For complete fee information, refer to the Intuitive Investor fee schedule (PDF). Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS). WFCS is not an FDIC-insured depository institution; FDIC deposit insurance only protects against the failure of an insured depository institution. Banking products and services provided by Wells Fargo Bank, N.A. Member FDIC.

3. Offer is valid for the first 90 days after account is opened. We will refund accrued advisory fees and waive account transfer or termination fees. To receive a refund, please call 1-855-283-5567 and refer to the Satisfaction Guarantee. The Satisfaction Guarantee does not apply to any market losses in your portfolio.

4. Wells Fargo & Company and its affiliates do not provide tax or legal advice. Please consult your tax and legal advisors to determine how this information may affect your own situation.

The Intuitive Investor program is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $500. Intuitive Investor is offered through Wells Fargo Clearing Services, LLC.

The Intuitive Investor program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $500.

Wells Fargo Investment Institute is a registered investment advisor and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of Wells Fargo & Company.

What is automated investing?

Automated investing, also called robo-investing or robo advisor, refers to the use of technology and algorithms to create diversified portfolios for investors and to monitor and re-balance the holdings as needed. Rebalancing keeps the asset allocation within a defined range based on the portfolio’s risk/reward profile.

Wells Fargo Intuitive Investor provides automated investment services plus access to Financial Advisors at no additional cost.

What is risk tolerance?

Risk tolerance, also known as risk appetite, is the degree of variability (risk) in investment returns that an investor is willing to withstand. We evaluate your risk appetite and recommend a portfolio based on your answers to the Intuitive Investor questionnaire.

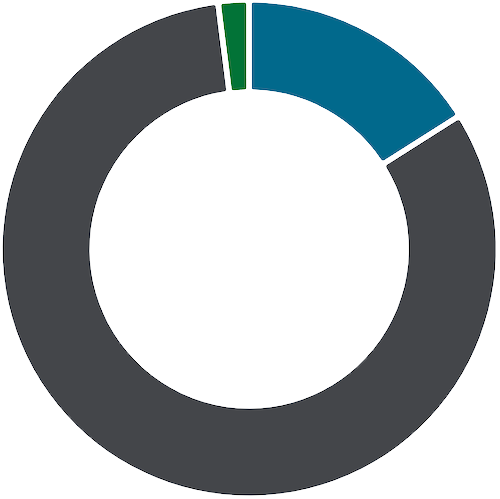

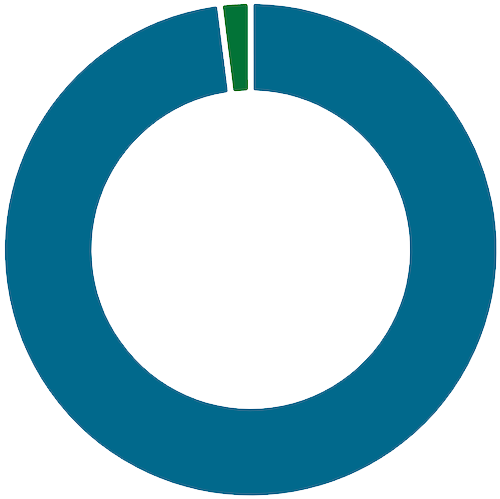

Globally Diversified

A Globally Diversified* portfolio balances risk and reward by investing in domestic and foreign markets.

*Keep in mind that diversification cannot eliminate the risk of fluctuating prices and uncertain returns.

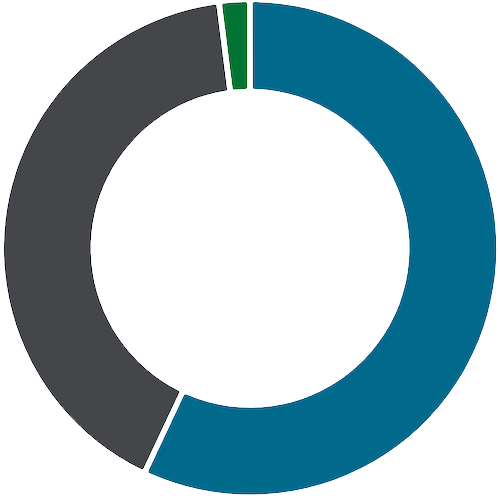

Sustainability Focused

A Sustainability Focused portfolio strives to provide investors with globally diversified* investments that have a measurable positive impact on the environment and society, by incorporating Environmental, Social & Governance (ESG) factors, while attempting to achieve risk and returns similar to traditional investment portfolios.

*Keep in mind that diversification cannot eliminate the risk of fluctuating prices and uncertain returns.

What is daily monitoring?

Daily monitoring tracks the performance of individual funds in your portfolio to ensure the asset allocation stays within an acceptable range. It allows for fluctuation within target ranges to avoid unnecessary or ineffective trading and rebalances your account only when needed.

What is compounding?

Compounding is the ability of an asset to generate earnings, which are then reinvested, or remain invested, with the goal of generating their own earnings. Over time, compounding can significantly increase your wealth.

What is dollar-cost averaging?

With dollar-cost averaging, rather than try to time the market, and end up buying and selling at the wrong time, you invest your money in equal portions, at regular intervals, regardless of the ups and downs in the market.

Globally Diversified

A Globally Diversified* portfolio balances risk and reward by investing in domestic and foreign markets.

*Keep in mind that diversification cannot eliminate the risk of fluctuating prices and uncertain returns.

Sustainability Focused

A Sustainability Focused portfolio strives to provide investors with globally diversified* investments that have a measurable positive impact on the environment and society, by incorporating Environmental, Social & Governance (ESG) factors, while attempting to achieve risk and returns similar to traditional investment portfolios.

*Keep in mind that diversification cannot eliminate the risk of fluctuating prices and uncertain returns.

Advisory fee

One advisory fee covers all account services:

- Account set-up

- Access to Financial Advisors

- Investment selection

- Commissions

- Trades

- Rebalancing

- Maintenance

- Tax Loss Harvesting (an optional services)

Other non-advisory fees will apply, including the underlying fees and expenses of the Exchange-Traded Funds in your portfolio.

What is the Satisfaction Guarantee?

If you're not satisfied with your Intuitive Investor account, you can activate the satisfaction guarantee within 90 days of your portfolio being invested. We'll refund all advisory fees paid during this period, and we'll also waive any outgoing account transfer and IRA termination fees. Please note that this guarantee does not protect you against market losses. Call 1-855-283-5567 for more information.